| Take a Closer Look at the Spring Boomlet: It’s a Remarkable Start |

| RISMEDIA, Tuesday, April 28, 2015— It’s official. Early forecasts of an extraordinary sales season are proving to be true. NAR’s March existing home sales rocketed to their highest annual rate in 18 months.

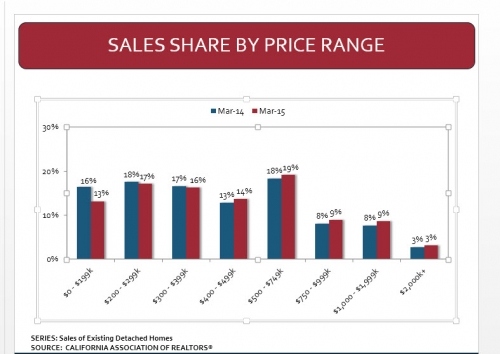

Total March sales increased 6.1 percent to a seasonally adjusted annual rate of 5.19 million in March from 4.89 million in February—the highest annual rate since September 2013 (also 5.19 million). Sales have increased year-over-year for six consecutive months and are now 10.4 percent above a year ago, the highest annual increase since August 2013 (10.7 percent). March’s sales increase was the largest monthly increase since December 2010 (6.2 percent). Even more remarkably, the median existing home price in March was $212,100, up 8 percent over last year, according to the NAR. The median price of active March listings on realtor.com®, was even higher, $220,000, up 11 percent over last year. Sellers are certainly pricing on the plus side. But this is not a bubble, writes realtor.com®’s Jonathan Smoke. “The level of the current price appreciation is not like the bubble. Prices went up 7 percent and 12 percent in 2012 and 2013, respectively, as the market corrected for too-severe price declines in the prior years. Last year, the appreciation level moderated. Even factoring in the one-time bounce from the prior overcorrection, median prices have grown less than 8 percent on a compounded annual basis over the past three years. Median prices, by comparison, grew 10 percent on a compounded annual basis from 2002 to 2005, without any bounce from a prior decline. On an inflation-adjusted basis, we are 30 percent beneath the peak set in 2005,” Smoke says. All that’s true, but there are other reasons not to break out the bubbly. At least not yet. First looks at sales data in larger markets suggests that the bulk of sales are to move up buyers in the mid-price tiers and luxury buyers in the top tiers. Since the first of the year, median list prices for sales homes on the market for at least $500,000 in the top 10 zip codes for 31 major metro markets have soared. The Institute for Luxury Home Marketing reports median prices higher than last year’s peak and an average 148 days on market and falling. In the MidAtlantic Region, where closed sales are up 20 percent over last year according to RBI, the median sold price rose only 0.4 percent over last year, suggesting that sales were balanced across the price spectrum. But that’s not the case. March closed sales soared for properties in the $1 million to $2.5 million bracket (up 31.5 percent yoy) and the $800k to $1 million bracket (up 21.8 percent year-over-year). March closed sales for homes priced from $50k to $200k were in the double digits, but just barely. Sales gained much more in the upper tiers, evidence of a significant shift in the market. In California, the shift in sales up the price ladder is even more striking. The California Association of Realtors broke out its March sales data by price bracket (below). Bars on the left are 2014 results, bars on the right are this year’s.

An exception to the “moving on up” trend was Florida, where a huge 24.6 percent increase in year over year sales left plenty of inventory at the upper ends. Statewide median sales price for single-family existing homes last month was $190,000, up 9.2 percent—far less than total sales–from the previous year, according to data from Florida REALTORS® Industry Data and Analysis department in partnership with local REALTOR® boards/associations. Sales growth was strong at the upper levels but stronger in the mid and entry level markets. One reason for Florida’s healthier price spread of sale may be a return of the owner-occupant. “The housing market continues to thrive on the growing Florida economy—jobs are up and so are sales,” says Florida REALTORS® Chief Economist Dr. John Tuccillo. “The continued fall of cash sales as a percentage of total sales suggests that demand is increasingly coming from household owner-occupants, a trend that bodes well for market stability.” Whatever happened to the “Year of the Millennial”? NAR reports the first-time homebuyer share returned to 30 percent in March, the same market share as a year ago and a slight increase from the 28-29 percent range over previous months and still shy of historical levels when it typically averaged 40 percent. “Having says that, risks remain with first-time homebuyers still underrepresented in the market given their restricted access to credit and lofty student debt.” says Michael Dolega, Senior Economist at TD Economics. In most markets, inventories of entry-level homes are thinnest yet prices rose the least in those brackets. Sales were flat to positive, but nowhere near the levels of mid and upper-tier price brackets. Despite reports of homebuyer traffic led by first-time homebuyers and current homeowners being up sharply in March and stronger than traffic a year ago, there’s so sign at all of the millennial onslaught so widely forecast. Measures of the mortgage market are certainly not picking up any signs. In March 2015, first-time buyers accounted for 56.6 percent of primary owner-occupied home purchase mortgages with a government guarantee (like FHA), according to AEI’s Agency First-Time Buyer Mortgage Share Index. The March share was slightly above the revised share of 56 percent for February and a shade below the March 2014 share of 57.1 percent. The first-time buyer share has displayed no trend over its 24-month history apart from seasonal variation. A rise in mid to upper tier home sales makes sense. Incomes are up, especially for senior works. Price increases in mid-tier homes have lagged lower and upper tiers, making it tough for move up buyers to sell their existing homes. However, we are seeing an upscale shift in buying patterns that could cause problems in the future, especially in affordability and rent vs buy comparisons in major markets. That millennials are not yet ready is a concern, especially in light of today’s interest rates and relatively affordable prices, conditions that will certainly change soon. But access to credit, debt and income issues are not the only problems facing first-timers. Inventories are frighteningly low in many major markets for this time of the year. Perhaps a mid to upper tier price fling is just what the doctor ordered to encourage move-uppers that now is the time to list their homes and make room for the coming generation. RISMedia welcomes your questions and comments. Send your e-mail to:realestatemagazinefeedback@rismedia.com. |